European football championship 2016

Sector playing field: food industry

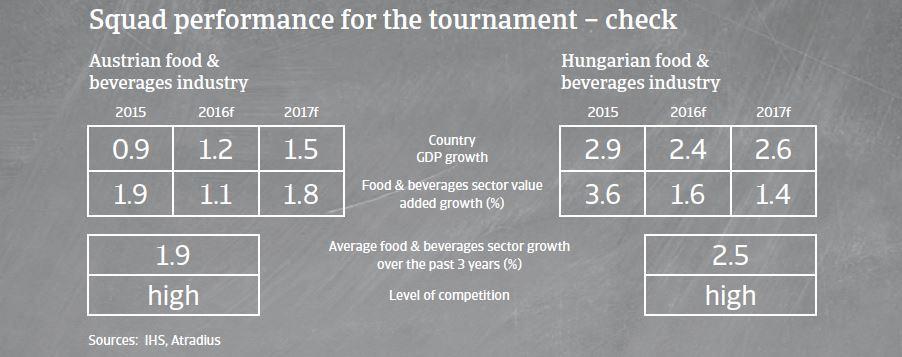

Austria: pressure on margins, but good away results

In 2015 the performance of the Austrian food production industry remained rather modest, as exports grew only slightly and domestic demand was affected by negative consumer sentiment. However, the performance in 2016 is expected to be more positive, with food production expected to increase about 2% year-on-year. Due to its geographical proximity, the Austrian food industry has benefitted from increasing food demand in Central and Eastern Europe. By exporting to overseas markets like the US, Austrian food businesses were widely able to compensate for losses caused by the Russian import ban.

In the domestic market the overwhelming market power of large retailers and discounters and the tough competition in the food retail sector indicate that food producers, processors and suppliers have found it difficult to pass on costs. As a result, especially smaller players face price and cost pressure, which negatively affect profit margins.

Hungary: scoring abroad

The food and beverages industry is one of the most important sectors of the Hungarian economy. It is the second-largest employer and the third-biggest producer in the manufacturing sector, accounting for more than 10% of the total industrial output. Food export revenues are a significant contributor to Hungary´s overall trade surplus.

Exports have emerged as the main driving force of the industry, expanding at a Compound Annual Growth Rate of 10.7% while domestic sales grew 4.8%. The main export products are fruits and vegetables, meat and dairy products, with over 90% of exports bound for the European Union.

Food turnover is expected to grow further in 2016, and while profitability of food businesses has increased in 2015 and is expected to remain stable in 2016, it still remains low compared to other Hungarian industries. One of the main challenges for the sector is the overall high tax burden, that dampens household consumption. Financial gearing of Hungarian food businesses is generally high, and can be a significant risk if a business´ profitability is weak.

Players to watch

Austria

During the last couple of years the beverages subsector has, on average, recorded higher growth rates than the food sector in general. This was mainly due to export growth in the energy and carbonated drinks segment, while Austrian wine producers benefit in their export business from higher sales prices, due to increased quality. That said, the Austrian and Western European beverages markets are fairly saturated, and further market concentration in this subsector is expected.

The meat subsector suffers from strong competition, stagnating domestic demand and high price pressure, mainly due to the market power of large retailers, while a consolidation process is on-going in this segment. Smaller meat producing or processing businesses remain under high pressure, while larger and export oriented companies are better off, as the high quality standard of Austrian meat products provide a competitive edge abroad.

Hungary

In 2014 and 2015 the fruit and vegetables, meat poultry, and bakery segments outperformed the average industry growth, boosted by increased foreign demand.

The beverage segment has seen a considerable market adjustment in the past few years. The wholesale beverage market is strongly concentrated (about 90% of turnover amounts to 19 wholesalers). The alcoholic beverages wholesalers are under review as there are rumours that the government may centralize this segment in the future.

In 2015 the dairy segment registered a below average performance due to several long-term structural problems.

Major strengths and weaknesses

Austrian food industry: strengths

Austrian food industry: strengths

- High quality of food and beverage products and high degree of specialisation

- Located closely to Eastern European markets

- Good growth prospects for certain segments (e.g. organic food)

- Banks are generally willing to lend to food businesses

Hungarian food industry: strengths

Hungarian food industry: strengths

- Food is traditionally one of the most important Hungarian industries

- Food export revenues are a significant contributor to Hungary's overall trade surplus

- Hungary's infrastructure is considered to be one of the best in the region, considerably facilitating the production and distribution processes

- Strond demand fundamentals and increasing exports sales

Austrian food industry: weaknesses

Austrian food industry: weaknesses

- Shrinking margins and high cost and price pressure

- Saturated markets in Western Europe

- Declining number of consumers and aging society in the domestic market

Hungarian food industry: weaknesses

Hungarian food industry: weaknesses

- High export exposure makes the sector susceptible to global volatility and crisis (e.g. Russian import ban)

- Large black market

- High VAT rate for food products on average

- Strong competition, often with cheaper import products

Fair play ranking: payment behaviours and insolvencies

Austrian food industry

Payment experience in the food industry has been good over the past two years. The number of protracted payments and non-payments is low, and is expected to remain stable over the coming six months.

The insolvency of a larger retailer in November 2015 has led to difficulties for some direct suppliers. Overall the insolvency level in the food sector is low.

It is expected that business failures will remain stable or record only a modest increase in 2016.

Hungarian food industry

The average payment duration in the Hungarian food industry amounts to 60 days.

The number of protracted payments, non-payments and insolvency cases has remained stable over the last six months, and no increase is expected in the coming months.

However, the food sector's insolvency rate is above average for Hungary (2.7% in 2015). For example, the insolvency rate of food and beverage producers was 3.5% in 2015.

Business failures in the food wholesalers segment increased significantly in 2014. Gearing and dependence on bank finance are generally high in the food sector.

Relaterte dokumenter

Industry match-ups Austria versus Hungary (EN)