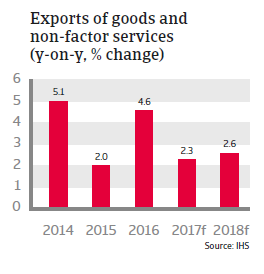

Despite rising Swiss exports in 2016, export-oriented businesses production costs had risen relative to their export prices, squeezing profit levels.

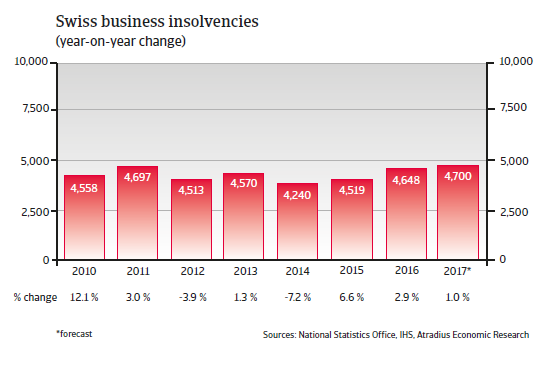

The insolvency environment

Corporate insolvencies expected to increase further in 2017

Since 2015 Swiss business insolvencies have recorded annual increases due to a more difficult economic environment. Despite a rebound of GDP growth, this trend is expected to continue in 2017, with business failures rising 1%, to 4,700 cases of bankrupt and over-indebted businesses.

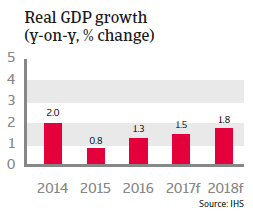

Economic situation

Growth expected to remain below 2% in 2017

In 2017 the gradual rebound is set to continue, with export growth forecast to continue and private consumption growth expected to pick up slightly. Consumer price inflation is forecast to remain below 1%.