Downside risks ahead, as demand from automotive is decreasing, while the nitrogen debate could seriously impact construction as a key buyer sector.

Although the steel and metals sector accounts for just about 1% of Dutch GDP, it is important as a leading supplier for construction, automotive and machinery. The industry is highly dependent on domestic construction sector performance. Additionally, many metals businesses are export-oriented, delivering items for offshore platforms (wind, oil and gas).

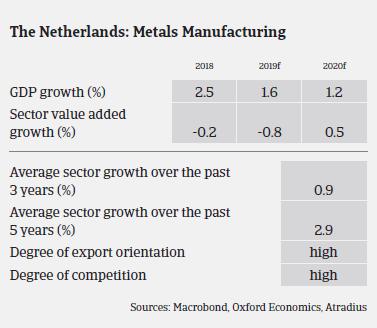

The Dutch metal and steel sector performed well in 2018 and H1 of 2019, supported by robust economic growth and ongoing demand from the construction sector. Profitability of metals and steel businesses has been high, and profit margins have increased over the past 12 months.

However, there are downside risks ahead. Metals and steel demand from automotive has started to decrease, and the ongoing discussion in the Netherlands over enviromental damages caused by nitrogen could seriously impact construction as a key buyer sector. In May 2019 the country’s highest administrative court ruled that the way Dutch builders and farmers dealt with nitrogen emissions was in breach of EU legislation. As a consequence up to 18,000 infrastructure and construction projects have been put on hold. While the final outcome of the nitrogen issue is not yet clear, it could potentially hamper metals and steel sales to the building industry.

Dutch metal and steel makers, traders and wholesalers are very dependent on bank financing. Financing is currently not an issue, as banks are still willing to lend to the sector. Payments in the Dutch metals and steel sector take 45 days on average. Payment delays and insolvencies are expected to remain rather stable in the coming months. It is expected that metals and steel insolvencies will level off in 2020 or slightly increase, by about 1%. However, in this respect the potential repercussion of the nitrogen issue remains a downside risk.

Our underwriting stance remains generally open due to the positive performance seen in 2018 and H1 of 2019, and the fact that most companies have reported good results so far. However, we closely monitor the impact of the ongoing nitrogen emission discussion on domestic construction, and also observe the current issues in the automotive industry, both being key buyer sectors for Dutch metal and steel businesses. Due to the increased downside risks we have downgraded our sector performance outlook for the metals segment from “Good” to “Fair”:

Relaterte dokumenter

1.06MB PDF